There are over 12,000 US sales and use tax jurisdictions in the US, and keeping up with the frequent changes takes a lot of time and effort. But there is a way to automate this - If you’re in a financial position within a print company, especially in North America, this one’s for you.

In this article, we’re going to look at how you can remove the pain of this process by integrating your MIS with a tax compliance system system such as Avalara AvaTax.

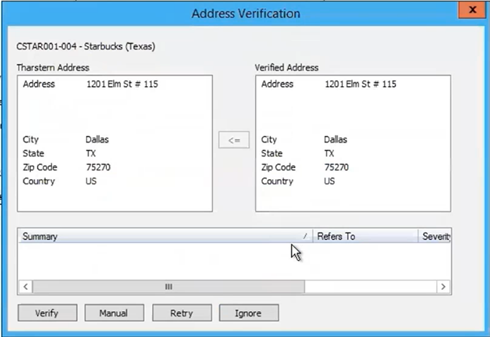

It's important to note that before using an integration such as this, you must make sure that the addresses you have in your MIS are correct. If they're not, you might be paying the wrong amount of taxes. In Tharstern you can do this by hitting the 'Verify' option for each customer and checking their address.

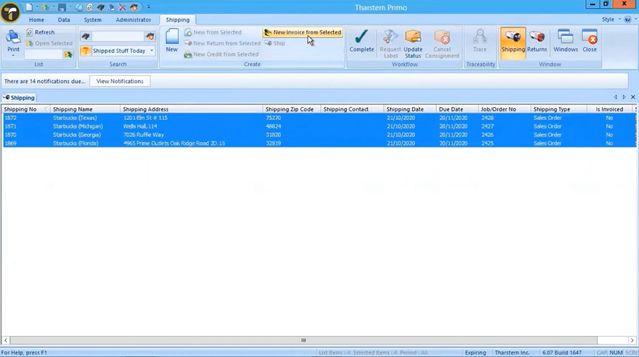

To demonstrate how the integration works, we're going to show you how to calculate the tax for 4 different jobs being shipped to multiple locations for the same customer.

By navigating to the shipping module of your MIS, you can apply a filter to identify jobs that have been shipped but haven’t yet been invoiced. In the screenshot below, you can see that the filter has identified four jobs for Starbucks that are shipping to different locations in different states.

By selecting everything in the list, we can create a consolidated sales invoice that includes the order and value of each item, but not the tax at this stage.

.png?width=767&name=Sales%20invoice%20(no%20tax).png)

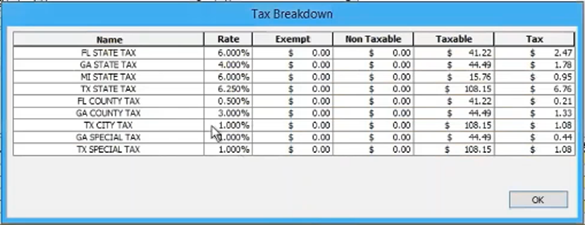

To have Avalara automatically calculate the tax for each job in this invoice, you just need to navigate to the sales invoice register, select the invoice and hit the ‘Calculate Tax’ button. The integration with AvaTax will automatically apply the correct tax amounts to each job. If you head back into the sales invoice and click the ‘Tax Breakdown’ button, you’ll see all the detail for how much tax has been applied for each location.

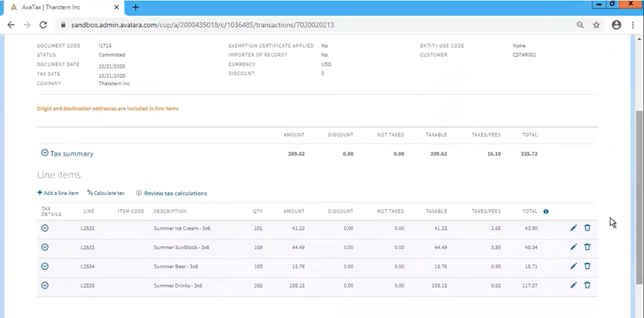

Once the tax has been applied within the MIS, it obviously needs to be paid too. You can do this from within the AvaTax product, where each line item has been added automatically via the integration. This data can then be submitted to the taxation services directly from AvaTax, saving you the pain of doing it yourself.

Staying compliant with US sales tax can be a time consuming and even stressful process, but by implementing a tax compliance product like AvaTax and integrating it with your MIS, you can make this process a lot easier!

If you’d like to see the integration in action, take a look at this video.